Q2 FY22 Earnings Presentation November 4, 2021 Exhibit 99.2

Q2 FY22 Earnings Call Agenda I. Introduction Crystal Gordon, SVP and General Counsel II. Operational Highlights Chris Bradshaw, President and CEO III. Financial Review Jennifer Whalen, SVP and CFO IV. Concluding Remarks Chris Bradshaw, President and CEO V. Questions & Answers 2

This presentation contains “forward-looking statements.” Forward-looking statements represent Bristow Group Inc.’s (the “Company”) current expectations or forecasts of future events. Forward-looking statements generally can be identified by the use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “estimate,” “anticipate,” “believe,” “project,” or “continue,” or other similar words. These statements are made under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, reflect management’s current views with respect to future events and therefore are subject to significant risks and uncertainties, both known and unknown. The Company’s actual results may vary materially from those anticipated in forward-looking statements. The Company cautions investors not to place undue reliance on any forward-looking statements. Forward-looking statements speak only as of the date of the document in which they are made. The Company disclaims any obligation or undertaking to provide any updates or revisions to any forward-looking statement to reflect any change in the Company’s expectations or any change in events, conditions or circumstances on which the forward-looking statement is based that occur after the date hereof. Risks that may affect forward-looking statements include, but are not necessarily limited to, those relating to: public health crises, such as pandemics (COVID-19) and epidemics, and any related government policies and actions; expected cost synergies and other financial or other benefits of the merger (“Merger”) might not be realized within the expected time frames, might be less than projected or may not be realized at all; the ability to successfully integrate the operations, accounting and administrative functions of Era Group Inc (“Era”) and the entity formerly known as Bristow Group Inc.(“Old Bristow“); managing a significantly larger company than before the completion of the Merger; diversion of management time on issues related to integration of the Company; the increase in indebtedness as a result of the Merger; operating costs, customer loss and business disruption following the Merger, including, without limitation, difficulties in maintaining relationships with employees and customers, may be greater than expected; our reliance on a limited number of customers and the reduction of our customer base as a result of bankruptcies or consolidation; the possibility that we may be unable to maintain compliance with covenants in our financing agreements; global and regional changes in the demand, supply, prices or other market conditions affecting oil and gas, including changes resulting from a public health crisis or from the imposition or lifting of crude oil production quotas or other actions that might be imposed by the Organization of Petroleum Exporting Countries (OPEC) and other producing countries; fluctuations in the demand for our services; the possibility that we may impair our long-lived assets and other assets, including inventory, property and equipment and investments in unconsolidated affiliates; our ability to implement operational improvement efficiencies with the objective of rightsizing our global footprint and further reducing our cost structure; the possibility of significant changes in foreign exchange rates and controls, including as a result of the U.K. having exited from the European Union (“E.U.”) (“Brexit”); the impact of continued uncertainty surrounding the effects Brexit will have on the British, EU and global economies and demand for oil and natural gas; potential effects of increased competition and the introduction of energy efficient alternative modes of transportation and solutions; the risk of future material weaknesses we may identify while we work to align policies, principles, and practices of the combined company following the Merger or any other failure by us to maintain effective internal controls; the possibility that we may be unable to re-deploy our aircraft to regions with greater demand; the possibility of changes in tax and other laws and regulations and policies, including, without limitation, actions of the Biden Administration that impact oil and gas operations or favor renewable energy projects in the U.S.; the possibility that we may be unable to dispose of older aircraft through sales into the aftermarket; general economic conditions, including the capital and credit markets; the possibility that segments of our fleet may be grounded for extended periods of time or indefinitely; the existence of operating risks inherent in our business, including the possibility of declining safety performance; the possibility of political instability, war or acts of terrorism in any of the countries where we operate; the possibility that reductions in spending on aviation services by governmental agencies could lead to modifications of our search and rescue (“SAR”) contract terms with the UK government, our contracts with the Bureau of Safety and Environmental Enforcement ("BSEE") or delays in receiving payments under such contracts; and our reliance on a limited number of helicopter manufacturers and suppliers capabilities.. You should not place undue reliance on our forward-looking statements because the matters they describe are subject to known and unknown risks, uncertainties and other unpredictable factors, many of which are beyond our control. Our forward-looking statements are based on the information currently available to us and speak only as of the date hereof. New risks and uncertainties arise from time to time, and it is impossible for us to predict these matters or how they may affect us. We have included important factors in the section entitled “Risk Factors” in the Company’s Annual Report on Form 10-K for the fiscal year ended March 31, 2021 (the “Annual Report”) which we believe over time, could cause our actual results, performance or achievements to differ from the anticipated results, performance or achievements that are expressed or implied by our forward-looking statements. You should consider all risks and uncertainties disclosed in the Annual Report and in our filings with the United States Securities and Exchange Commission (the “SEC”), all of which are accessible on the SEC’s website at www.sec.gov. Cautionary Statement Regarding Forward-Looking Statements 3

Non-GAAP In addition to financial results calculated in accordance with U.S. generally accepted accounting principles (“GAAP”), this presentation includes certain non-GAAP measures including EBITDA, Adjusted EBITDA, Net Debt, Free Cash Flow and Adjusted Free Cash Flow. EBITDA and Adjusted EBITDA are presented as supplemental measures of the Company’s operating performance. EBITDA is defined as Earnings before Interest expense, Taxes, Depreciation and Amortization. Adjusted EBITDA is defined as EBITDA further adjusted for special items that occurred during the reporting period and noted in the applicable reconciliation. Since neither EBITDA nor Adjusted EBITDA is a recognized term under GAAP, they should not be used as an indicator of, or an alternative to, net income as a measure of operating performance. In addition, EBITDA and Adjusted EBITDA are not intended to be measures of free cash flow available for discretionary use, as they do not take into account certain cash requirements, such as debt service requirements. Because the definitions of EBITDA and Adjusted EBITDA (or similar measures) may vary among companies and industries, they may not be comparable to other similarly titled measures used by other companies. Free Cash Flow represents the Company’s net cash provided by operating activities plus proceeds from disposition of property and equipment, less expenditures related to purchases of property and equipment. Adjusted Free Cash Flow is Free Cash Flow adjusted to exclude professional services fees and other costs paid in relation to the Merger, the implementation of fresh-start accounting and the voluntary petitions filed by Old Bristow and certain of its subsidiaries on May 11, 2019 in the U.S. Bankruptcy Court for the Southern District of Texas, Houston Division seeking relief under Chapter 11 of Title 11 of the U.S. Code (the “Chapter 11 Cases”). Management believes that the use of Adjusted Free Cash Flow is meaningful as it measures the Company’s ability to generate cash from its business after excluding cash payments for special items. Management uses this information as an analytical indicator to assess the Company’s liquidity and performance. However, investors should note numerous methods may exist for calculating a company's free cash flow. As a result, the method used by management to calculate Adjusted Free Cash Flow may differ from the methods used by other companies to calculate their free cash flow. The Company also presents Net Debt, which is a non-GAAP measure, defined as total principal balance on borrowings less unrestricted cash and cash equivalents. Each of these non-GAAP measures has limitations and therefore should not be used in isolation or as a substitute for the amounts reported in accordance with GAAP. A reconciliation of each of EBITDA, Adjusted EBITDA, Adjusted EBITDA excluding gains or losses on asset dispositions, Free Cash Flow, Adjusted Free Cash Flow, and net debt is included elsewhere in this presentation. Non-GAAP Financial Measures Reconciliation 4

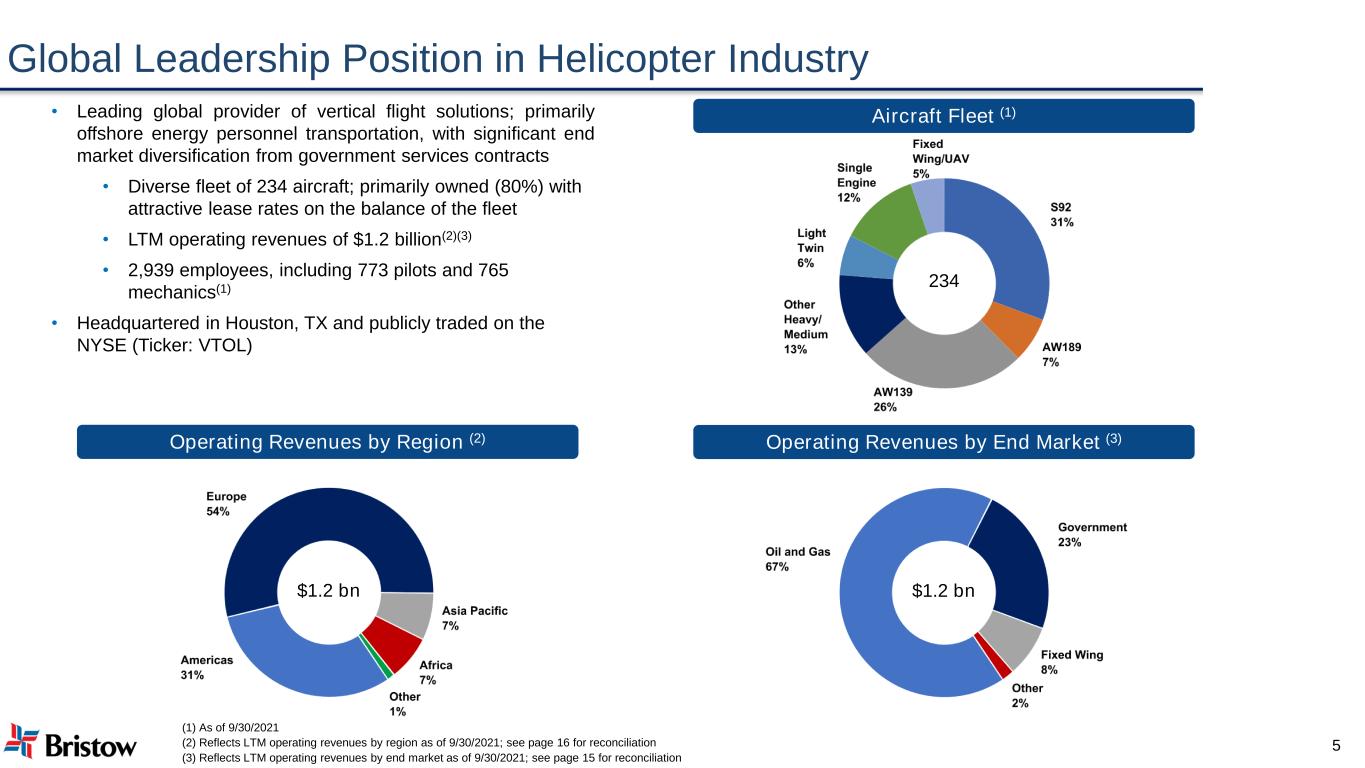

Global Leadership Position in Helicopter Industry Aircraft Fleet (1)• Leading global provider of vertical flight solutions; primarily offshore energy personnel transportation, with significant end market diversification from government services contracts • Diverse fleet of 234 aircraft; primarily owned (80%) with attractive lease rates on the balance of the fleet • LTM operating revenues of $1.2 billion(2)(3) • 2,939 employees, including 773 pilots and 765 mechanics(1) • Headquartered in Houston, TX and publicly traded on the NYSE (Ticker: VTOL) Operating Revenues by End Market (3) (1) As of 9/30/2021 (2) Reflects LTM operating revenues by region as of 9/30/2021; see page 16 for reconciliation (3) Reflects LTM operating revenues by end market as of 9/30/2021; see page 15 for reconciliation 234 $1.2 bn 5 Operating Revenues by Region (2) $1.2 bn

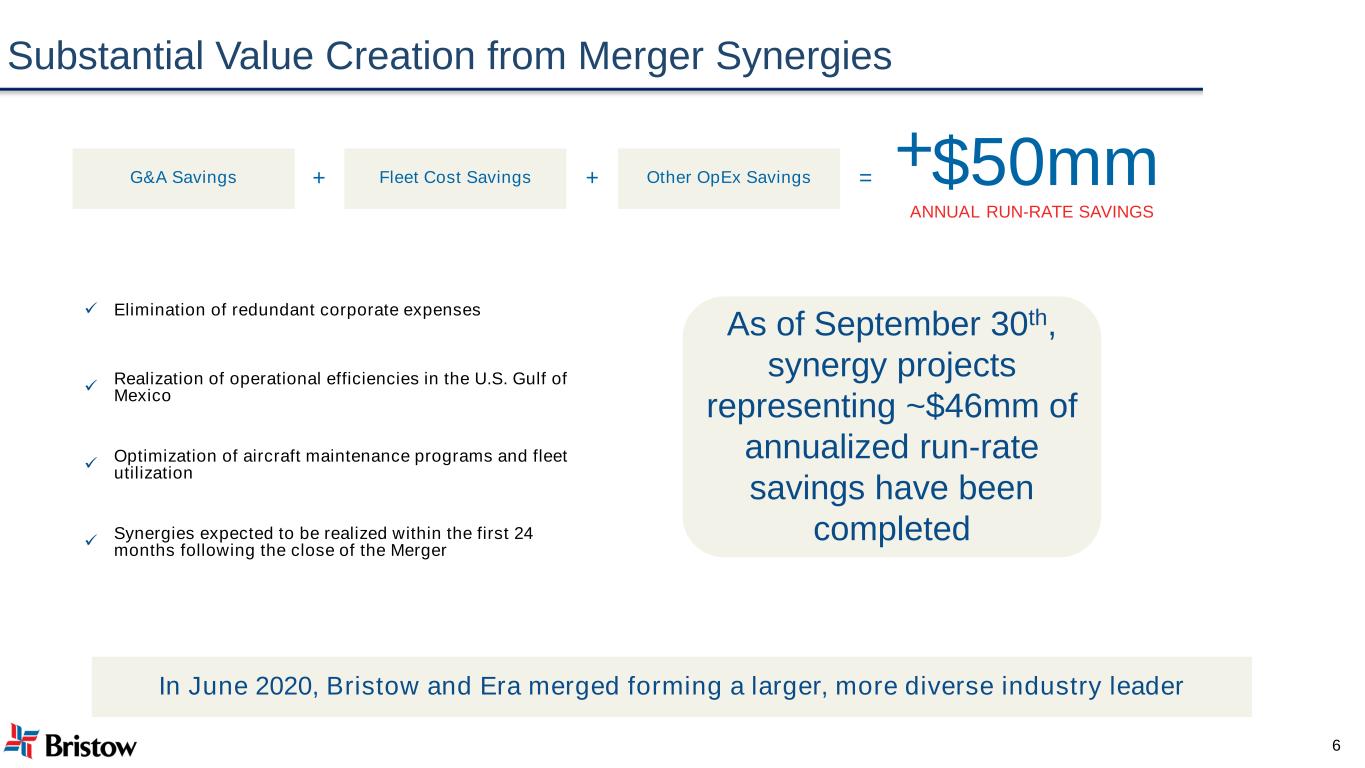

Substantial Value Creation from Merger Synergies As of September 30th, synergy projects representing ~$46mm of annualized run-rate savings have been completed ✓ Elimination of redundant corporate expenses ✓ Realization of operational efficiencies in the U.S. Gulf of Mexico ✓ Optimization of aircraft maintenance programs and fleet utilization ✓ Synergies expected to be realized within the first 24 months following the close of the Merger G&A Savings Fleet Cost Savings Other OpEx Savings 6 + + = +$50mm ANNUAL RUN-RATE SAVINGS In June 2020, Bristow and Era merged forming a larger, more diverse industry leader

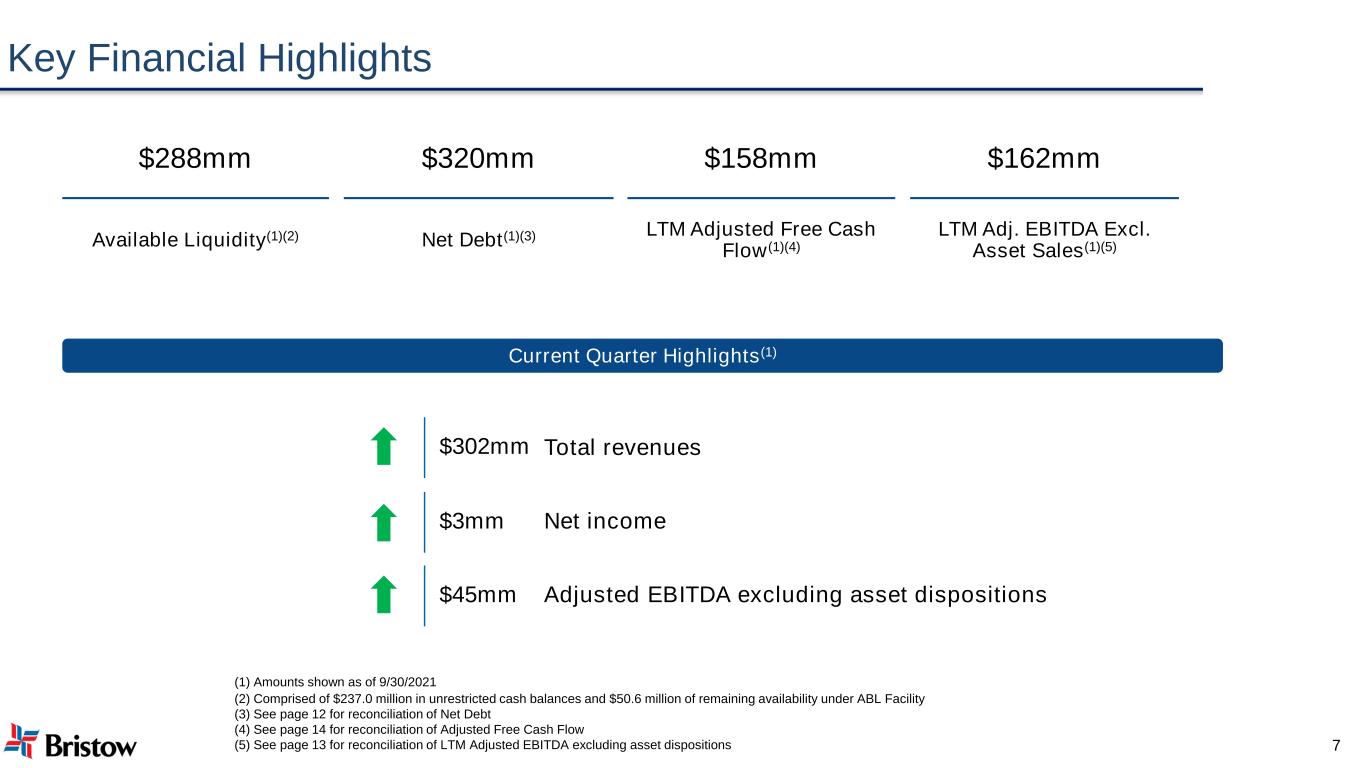

$302mm Total revenues $3mm Net income $45mm Adjusted EBITDA excluding asset dispositions Key Financial Highlights (1) Amounts shown as of 9/30/2021 (2) Comprised of $237.0 million in unrestricted cash balances and $50.6 million of remaining availability under ABL Facility (3) See page 12 for reconciliation of Net Debt (4) See page 14 for reconciliation of Adjusted Free Cash Flow (5) See page 13 for reconciliation of LTM Adjusted EBITDA excluding asset dispositions 7 $288mm $320mm $158mm $162mm Available Liquidity(1)(2) Net Debt(1)(3) LTM Adjusted Free Cash Flow(1)(4) LTM Adj. EBITDA Excl. Asset Sales(1)(5) Current Quarter Highlights(1)

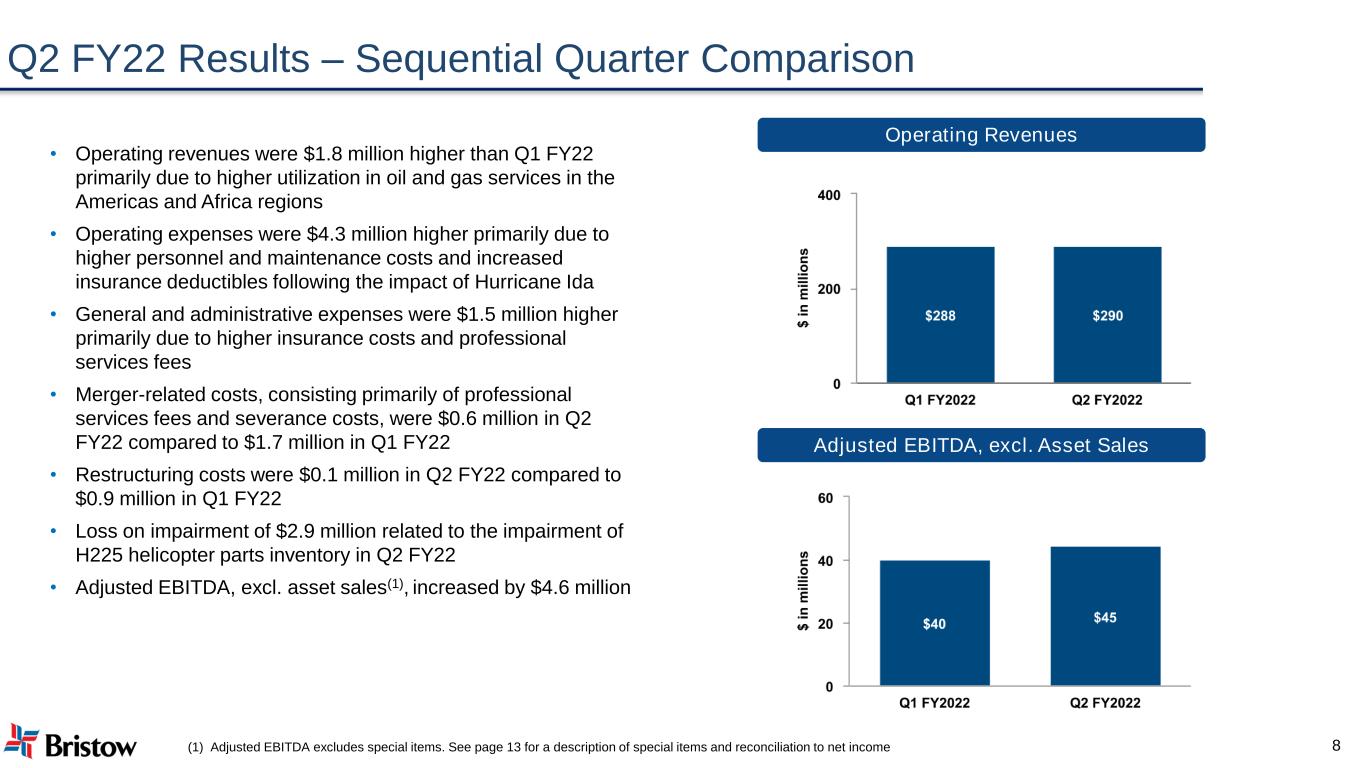

Q2 FY22 Results – Sequential Quarter Comparison • Operating revenues were $1.8 million higher than Q1 FY22 primarily due to higher utilization in oil and gas services in the Americas and Africa regions • Operating expenses were $4.3 million higher primarily due to higher personnel and maintenance costs and increased insurance deductibles following the impact of Hurricane Ida • General and administrative expenses were $1.5 million higher primarily due to higher insurance costs and professional services fees • Merger-related costs, consisting primarily of professional services fees and severance costs, were $0.6 million in Q2 FY22 compared to $1.7 million in Q1 FY22 • Restructuring costs were $0.1 million in Q2 FY22 compared to $0.9 million in Q1 FY22 • Loss on impairment of $2.9 million related to the impairment of H225 helicopter parts inventory in Q2 FY22 • Adjusted EBITDA, excl. asset sales(1), increased by $4.6 million Operating Revenue Operating Revenues Adjusted EBITDA, excl. Asset Sales (1) Adjusted EBITDA excludes special items. See page 13 for a description of special items and reconciliation to net income 8

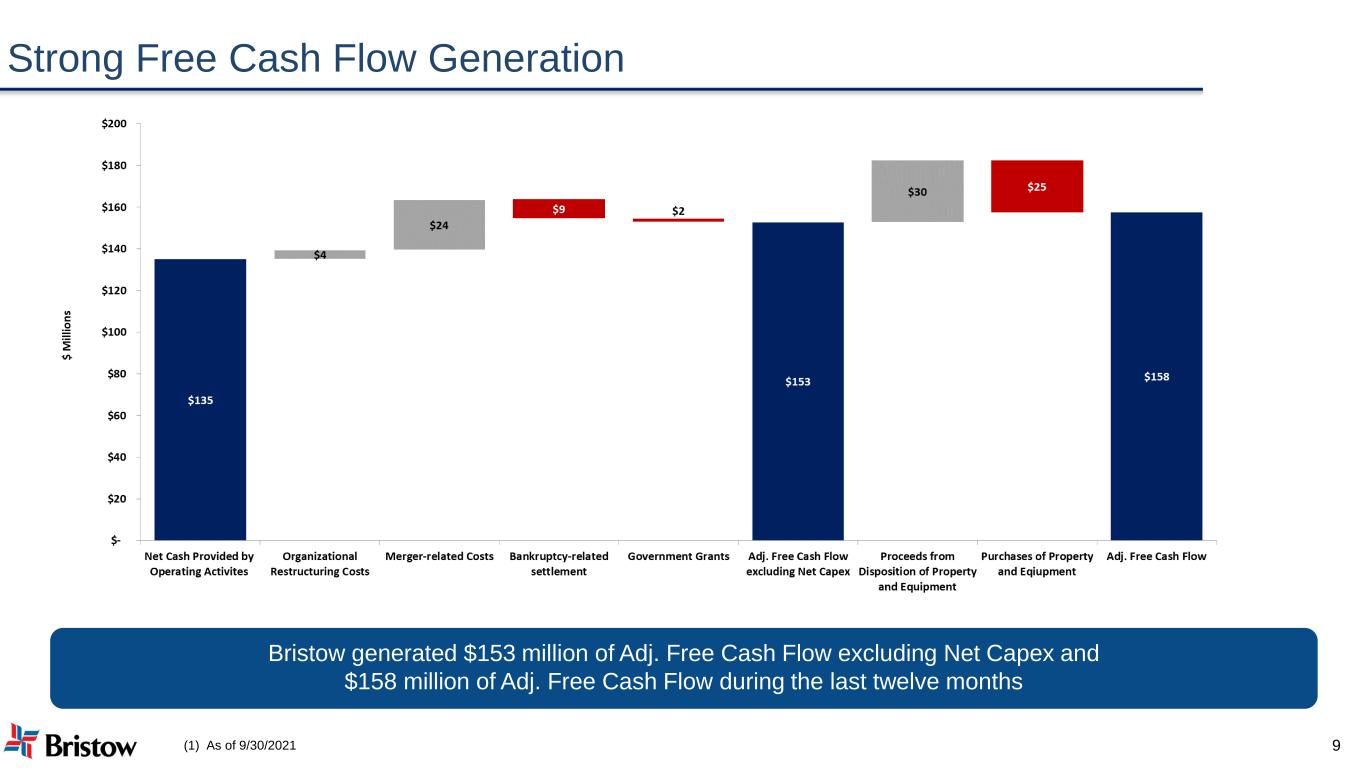

Strong Free Cash Flow Generation Bristow generated $153 million of Adj. Free Cash Flow excluding Net Capex and $158 million of Adj. Free Cash Flow during the last twelve months (1) As of 9/30/2021 9

10 11 Appendix Appendix ⮚ Fleet Overview ⮚ Balance Sheet and Liquidity Position ⮚ Reconciliation of LTM Adjusted EBITDA ⮚ Reconciliation of Free Cash Flow ⮚ Operating Revenues and Flight Hours by Line of Service ⮚ LTM Operating Revenues

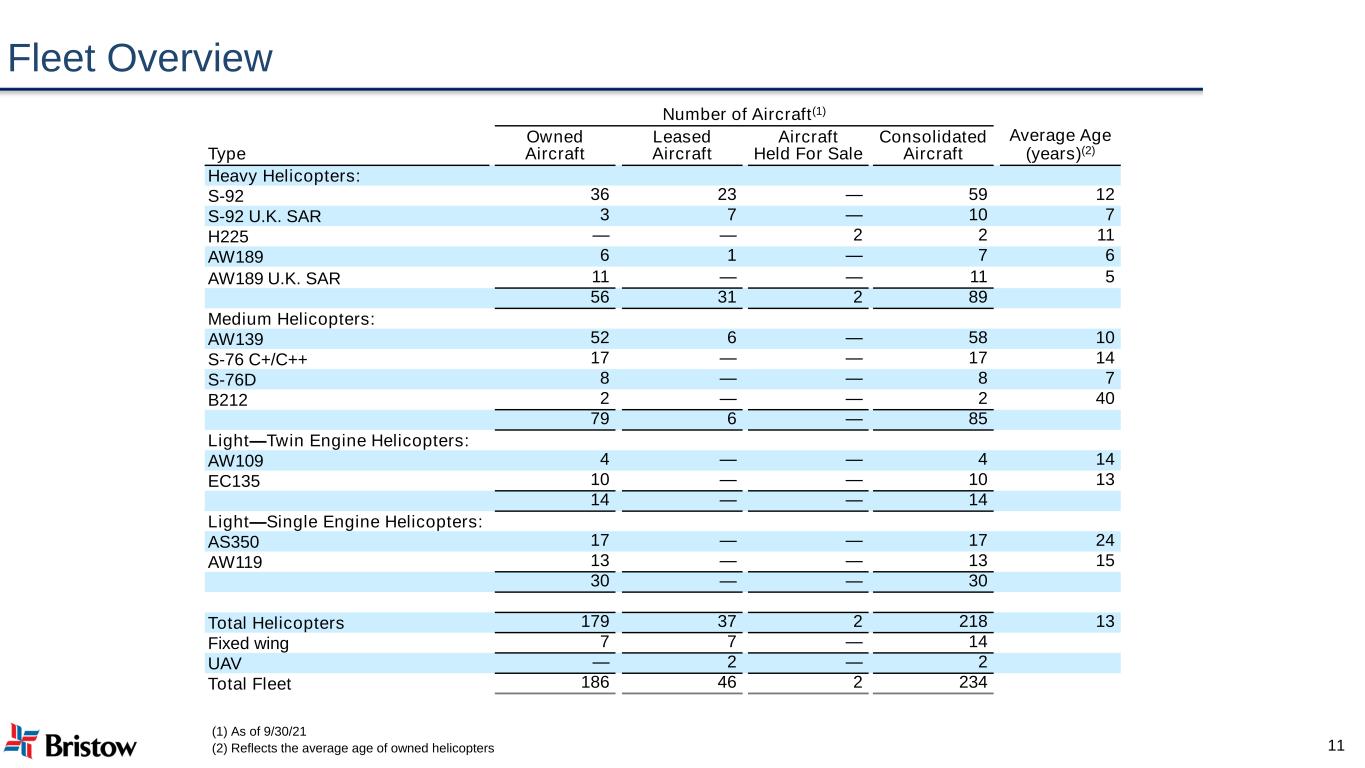

Fleet Overview Number of Aircraft(1) Type Owned Aircraft Leased Aircraft Aircraft Held For Sale Consolidated Aircraft Average Age (years)(2) Heavy Helicopters: S-92 36 23 — 59 12 S-92 U.K. SAR 3 7 — 10 7 H225 — — 2 2 11 AW189 6 1 — 7 6 AW189 U.K. SAR 11 — — 11 5 56 31 2 89 Medium Helicopters: AW139 52 6 — 58 10 S-76 C+/C++ 17 — — 17 14 S-76D 8 — — 8 7 B212 2 — — 2 40 79 6 — 85 Light—Twin Engine Helicopters: AW109 4 — — 4 14 EC135 10 — — 10 13 14 — — 14 Light—Single Engine Helicopters: AS350 17 — — 17 24 AW119 13 — — 13 15 30 — — 30 Total Helicopters 179 37 2 218 13 Fixed wing 7 7 — 14 UAV — 2 — 2 Total Fleet 186 46 2 234 (1) As of 9/30/21 (2) Reflects the average age of owned helicopters 11

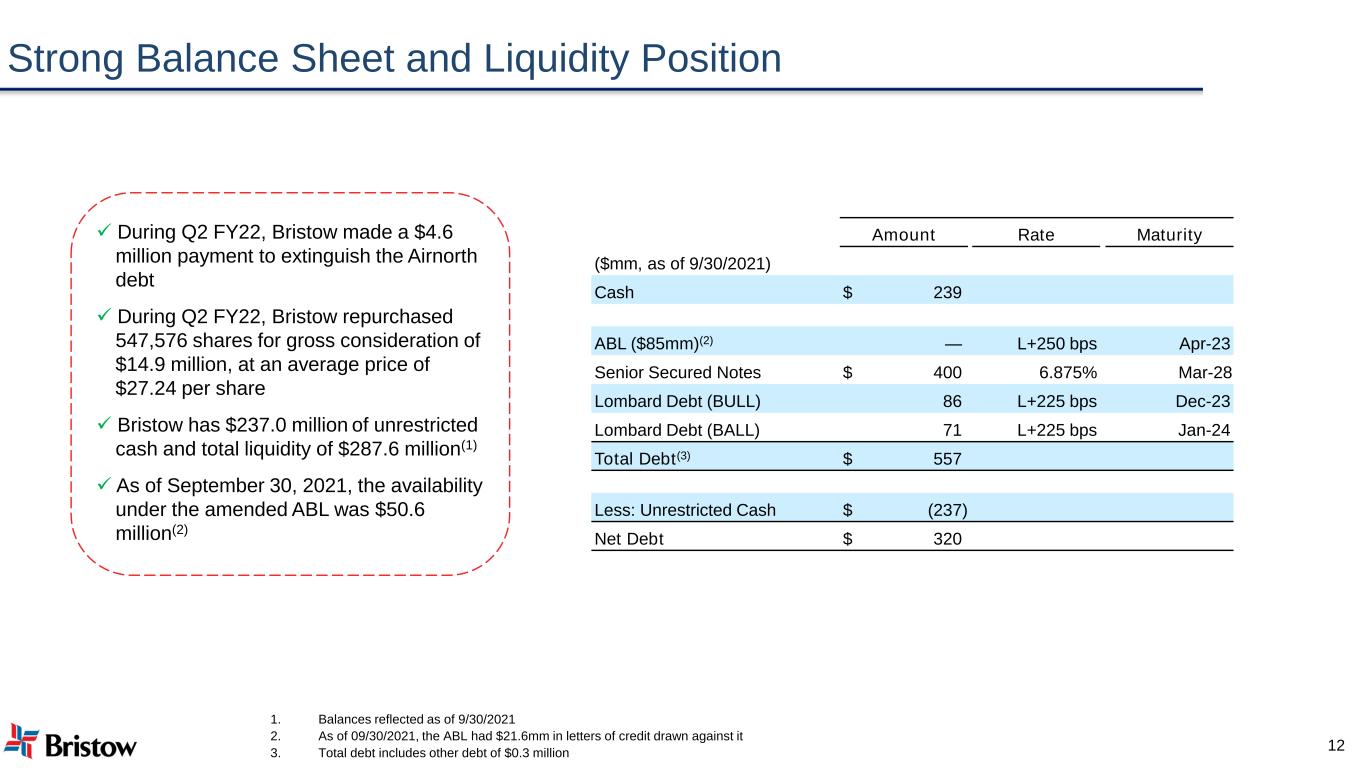

Strong Balance Sheet and Liquidity Position ✓ During Q2 FY22, Bristow made a $4.6 million payment to extinguish the Airnorth debt ✓ During Q2 FY22, Bristow repurchased 547,576 shares for gross consideration of $14.9 million, at an average price of $27.24 per share ✓ Bristow has $237.0 million of unrestricted cash and total liquidity of $287.6 million(1) ✓ As of September 30, 2021, the availability under the amended ABL was $50.6 million(2) 1. Balances reflected as of 9/30/2021 2. As of 09/30/2021, the ABL had $21.6mm in letters of credit drawn against it 3. Total debt includes other debt of $0.3 million Amount Rate Maturity ($mm, as of 9/30/2021) Cash $ 239 ABL ($85mm)(2) — L+250 bps Apr-23 Senior Secured Notes $ 400 6.875% Mar-28 Lombard Debt (BULL) 86 L+225 bps Dec-23 Lombard Debt (BALL) 71 L+225 bps Jan-24 Total Debt(3) $ 557 Less: Unrestricted Cash $ (237) Net Debt $ 320 12

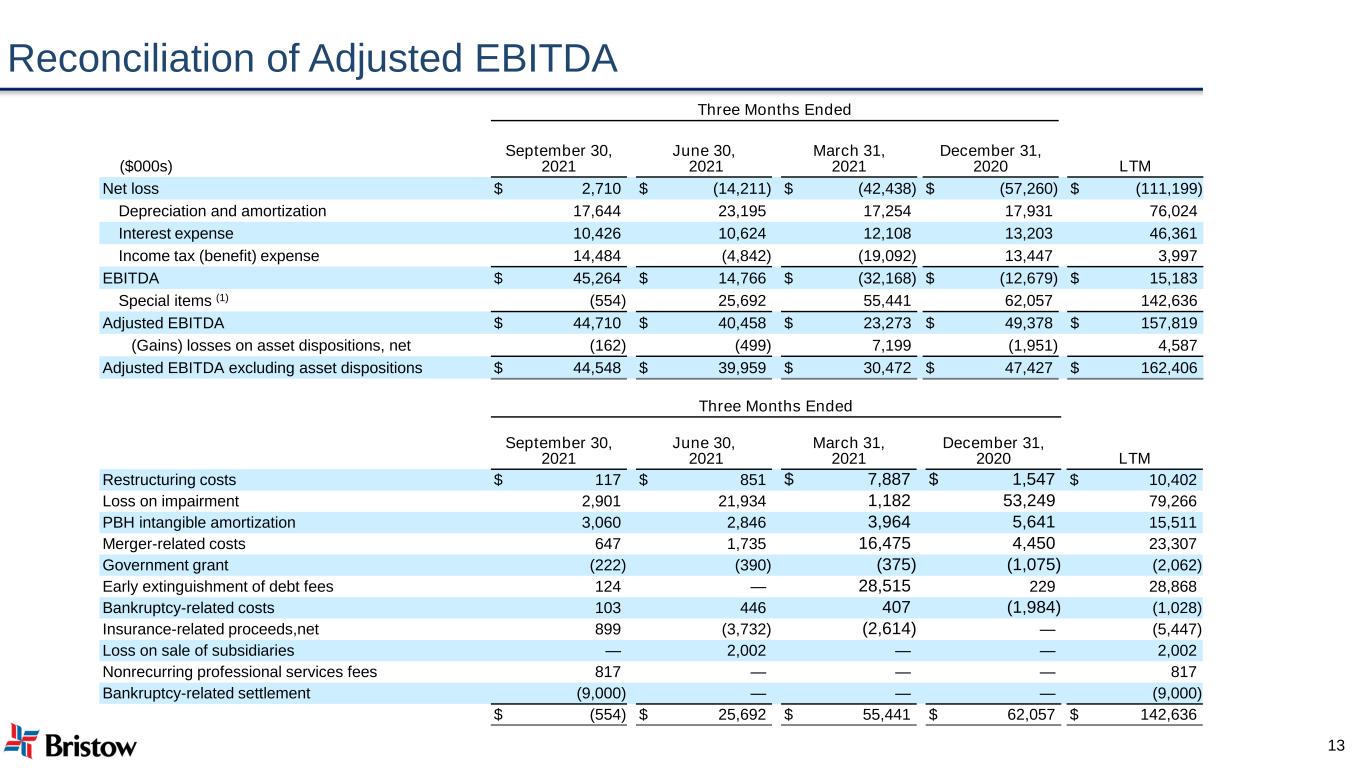

Reconciliation of Adjusted EBITDA Three Months Ended ($000s) September 30, 2021 June 30, 2021 March 31, 2021 December 31, 2020 LTM Net loss $ 2,710 $ (14,211) $ (42,438) $ (57,260) $ (111,199) Depreciation and amortization 17,644 23,195 17,254 17,931 76,024 Interest expense 10,426 10,624 12,108 13,203 46,361 Income tax (benefit) expense 14,484 (4,842) (19,092) 13,447 3,997 EBITDA $ 45,264 $ 14,766 $ (32,168) $ (12,679) $ 15,183 Special items (1) (554) 25,692 55,441 62,057 142,636 Adjusted EBITDA $ 44,710 $ 40,458 $ 23,273 $ 49,378 $ 157,819 (Gains) losses on asset dispositions, net (162) (499) 7,199 (1,951) 4,587 Adjusted EBITDA excluding asset dispositions $ 44,548 $ 39,959 $ 30,472 $ 47,427 $ 162,406 13 Three Months Ended September 30, 2021 June 30, 2021 March 31, 2021 December 31, 2020 LTM Restructuring costs $ 117 $ 851 $ 7,887 $ 1,547 $ 10,402 Loss on impairment 2,901 21,934 1,182 53,249 79,266 PBH intangible amortization 3,060 2,846 3,964 5,641 15,511 Merger-related costs 647 1,735 16,475 4,450 23,307 Government grant (222) (390) (375) (1,075) (2,062) Early extinguishment of debt fees 124 — 28,515 229 28,868 Bankruptcy-related costs 103 446 407 (1,984) (1,028) Insurance-related proceeds,net 899 (3,732) (2,614) — (5,447) Loss on sale of subsidiaries — 2,002 — — 2,002 Nonrecurring professional services fees 817 — — — 817 Bankruptcy-related settlement (9,000) — — — (9,000) $ (554) $ 25,692 $ 55,441 $ 62,057 $ 142,636

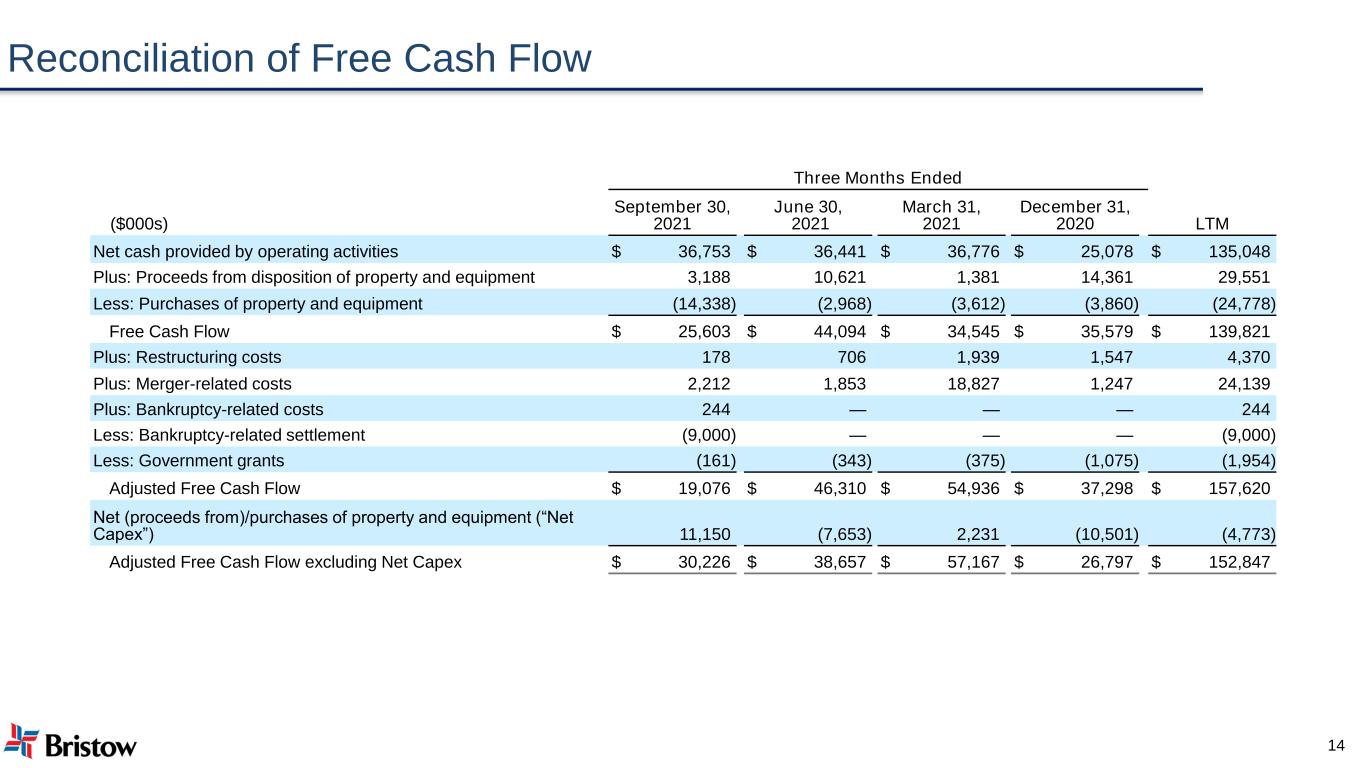

Reconciliation of Free Cash Flow Three Months Ended ($000s) September 30, 2021 June 30, 2021 March 31, 2021 December 31, 2020 LTM Net cash provided by operating activities $ 36,753 $ 36,441 $ 36,776 $ 25,078 $ 135,048 Plus: Proceeds from disposition of property and equipment 3,188 10,621 1,381 14,361 29,551 Less: Purchases of property and equipment (14,338) (2,968) (3,612) (3,860) (24,778) Free Cash Flow $ 25,603 $ 44,094 $ 34,545 $ 35,579 $ 139,821 Plus: Restructuring costs 178 706 1,939 1,547 4,370 Plus: Merger-related costs 2,212 1,853 18,827 1,247 24,139 Plus: Bankruptcy-related costs 244 — — — 244 Less: Bankruptcy-related settlement (9,000) — — — (9,000) Less: Government grants (161) (343) (375) (1,075) (1,954) Adjusted Free Cash Flow $ 19,076 $ 46,310 $ 54,936 $ 37,298 $ 157,620 Net (proceeds from)/purchases of property and equipment (“Net Capex”) 11,150 (7,653) 2,231 (10,501) (4,773) Adjusted Free Cash Flow excluding Net Capex $ 30,226 $ 38,657 $ 57,167 $ 26,797 $ 152,847 14

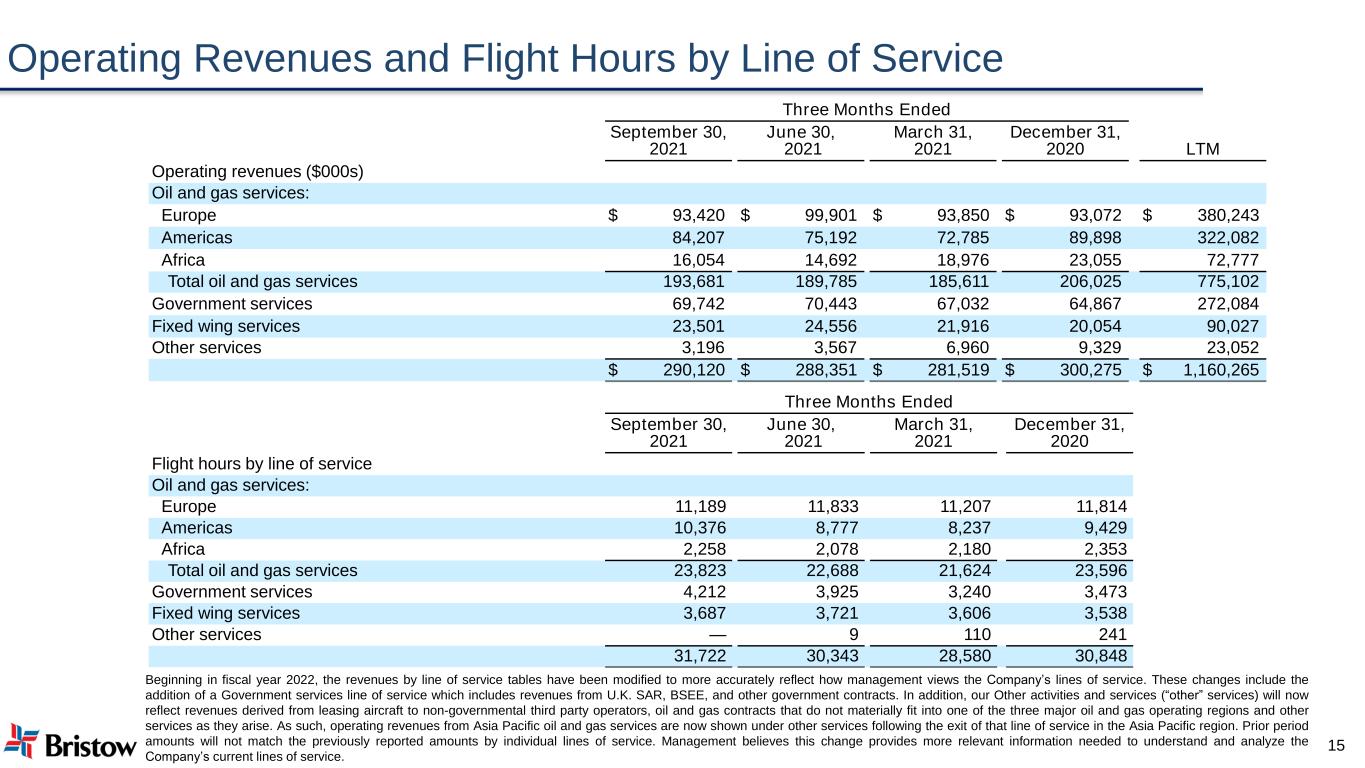

Operating Revenues and Flight Hours by Line of Service Three Months Ended September 30, 2021 June 30, 2021 March 31, 2021 December 31, 2020 LTM Operating revenues ($000s) Oil and gas services: Europe $ 93,420 $ 99,901 $ 93,850 $ 93,072 $ 380,243 Americas 84,207 75,192 72,785 89,898 322,082 Africa 16,054 14,692 18,976 23,055 72,777 Total oil and gas services 193,681 189,785 185,611 206,025 775,102 Government services 69,742 70,443 67,032 64,867 272,084 Fixed wing services 23,501 24,556 21,916 20,054 90,027 Other services 3,196 3,567 6,960 9,329 23,052 $ 290,120 $ 288,351 $ 281,519 $ 300,275 $ 1,160,265 Three Months Ended September 30, 2021 June 30, 2021 March 31, 2021 December 31, 2020 Flight hours by line of service Oil and gas services: Europe 11,189 11,833 11,207 11,814 Americas 10,376 8,777 8,237 9,429 Africa 2,258 2,078 2,180 2,353 Total oil and gas services 23,823 22,688 21,624 23,596 Government services 4,212 3,925 3,240 3,473 Fixed wing services 3,687 3,721 3,606 3,538 Other services — 9 110 241 31,722 30,343 28,580 30,848 Beginning in fiscal year 2022, the revenues by line of service tables have been modified to more accurately reflect how management views the Company’s lines of service. These changes include the addition of a Government services line of service which includes revenues from U.K. SAR, BSEE, and other government contracts. In addition, our Other activities and services (“other” services) will now reflect revenues derived from leasing aircraft to non-governmental third party operators, oil and gas contracts that do not materially fit into one of the three major oil and gas operating regions and other services as they arise. As such, operating revenues from Asia Pacific oil and gas services are now shown under other services following the exit of that line of service in the Asia Pacific region. Prior period amounts will not match the previously reported amounts by individual lines of service. Management believes this change provides more relevant information needed to understand and analyze the Company’s current lines of service. 15

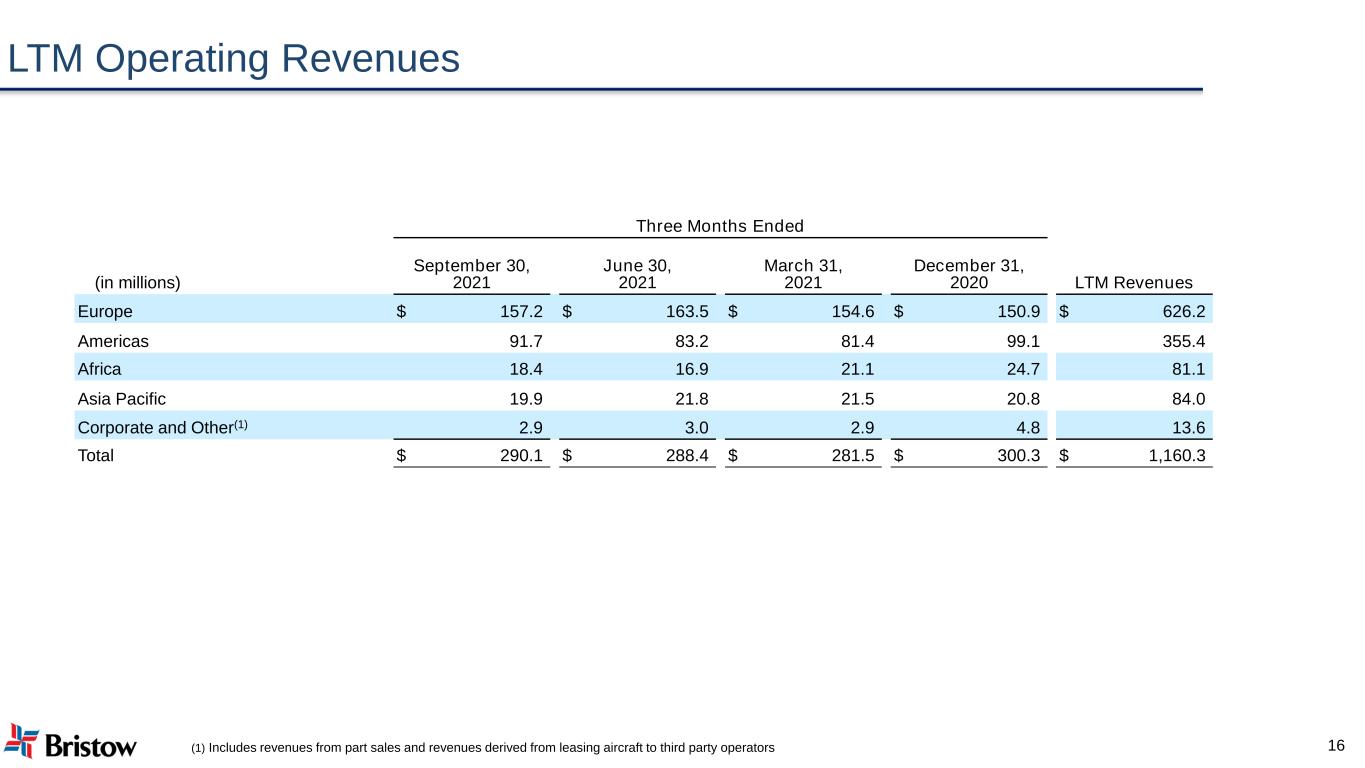

LTM Operating Revenues Three Months Ended (in millions) September 30, 2021 June 30, 2021 March 31, 2021 December 31, 2020 LTM Revenues Europe $ 157.2 $ 163.5 $ 154.6 $ 150.9 $ 626.2 Americas 91.7 83.2 81.4 99.1 355.4 Africa 18.4 16.9 21.1 24.7 81.1 Asia Pacific 19.9 21.8 21.5 20.8 84.0 Corporate and Other(1) 2.9 3.0 2.9 4.8 13.6 Total $ 290.1 $ 288.4 $ 281.5 $ 300.3 $ 1,160.3 16(1) Includes revenues from part sales and revenues derived from leasing aircraft to third party operators